Expense Receipt Fraud Detection: Leveraging DATABASICS's Advanced Capabilities

Summary

The emergence of AI-generated fake receipts has created new concerns for expense management professionals. However, the reality is more nuanced than the hype suggests. While AI image generators can create convincing fake receipts, the effort required often exceeds the potential gain for typical expense fraud scenarios.

DATABASICS provides comprehensive expense reporting capabilities like OCR receipt matching, a robust auditing module, integration capabilities and partnerships with leading AI detection experts, and prepaid cards for controlling spend before it happens. Our approach focuses on practical, effective solutions that support honest employees while catching genuine fraud attempts through intelligent automation.

How It Works

DATABASICS reviews your policies, data flows, and challenges faced by users to implement improvements such as refining policies, updating labels, enhancing configurations, and training AI. They also assess unusual charges and evaluate policy effectiveness to ensure accurate and efficient audit and validation processes.

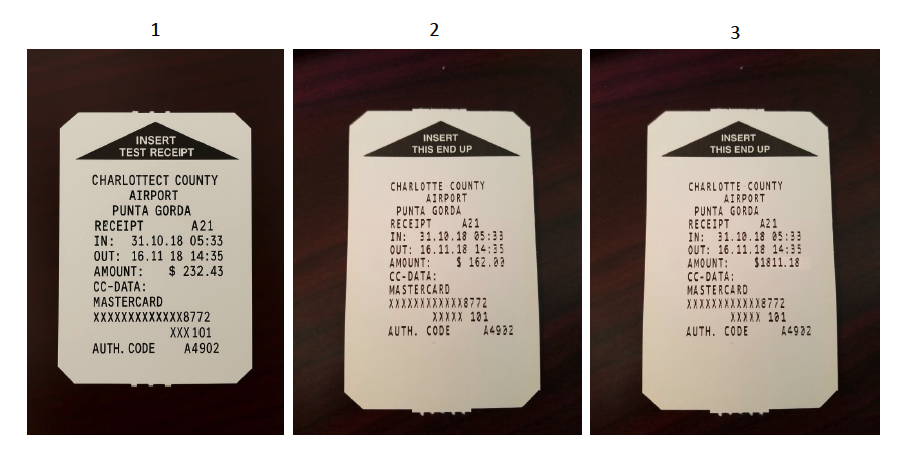

Can you spot the fake receipt above?

01 Types of Fake Receipts & Fraud Overview

Understanding the modern fraud landscape and detection capabilities

Current Fraud Landscape

The digital transformation of business processes has introduced new opportunities and challenges in expense management. The recent availability of AI-generated and digitally altered imagery has expanded the toolkit available to potential fraudsters, but it's important to understand the practical limitations and actual risk levels.

- AI-generated receipts require significant technical effort

- Most fraud attempts remain low-tech and easily detectable

- Advanced forensic tools can identify sophisticated attempts

- Cost-benefit analysis favors prevention over detection

Understanding Expenses: Beyond the Imagery

Examining a receipt alone isn't sufficient; it demands context around the expense, including patterns and the time of day. Even AI sometimes fails to recognize these nuances. Interestingly, AI that generates a fake receipt may not even realize it's not real. Therefore, we must look beyond just fake receipts and consider multiple aspects to gain a clearer understanding.

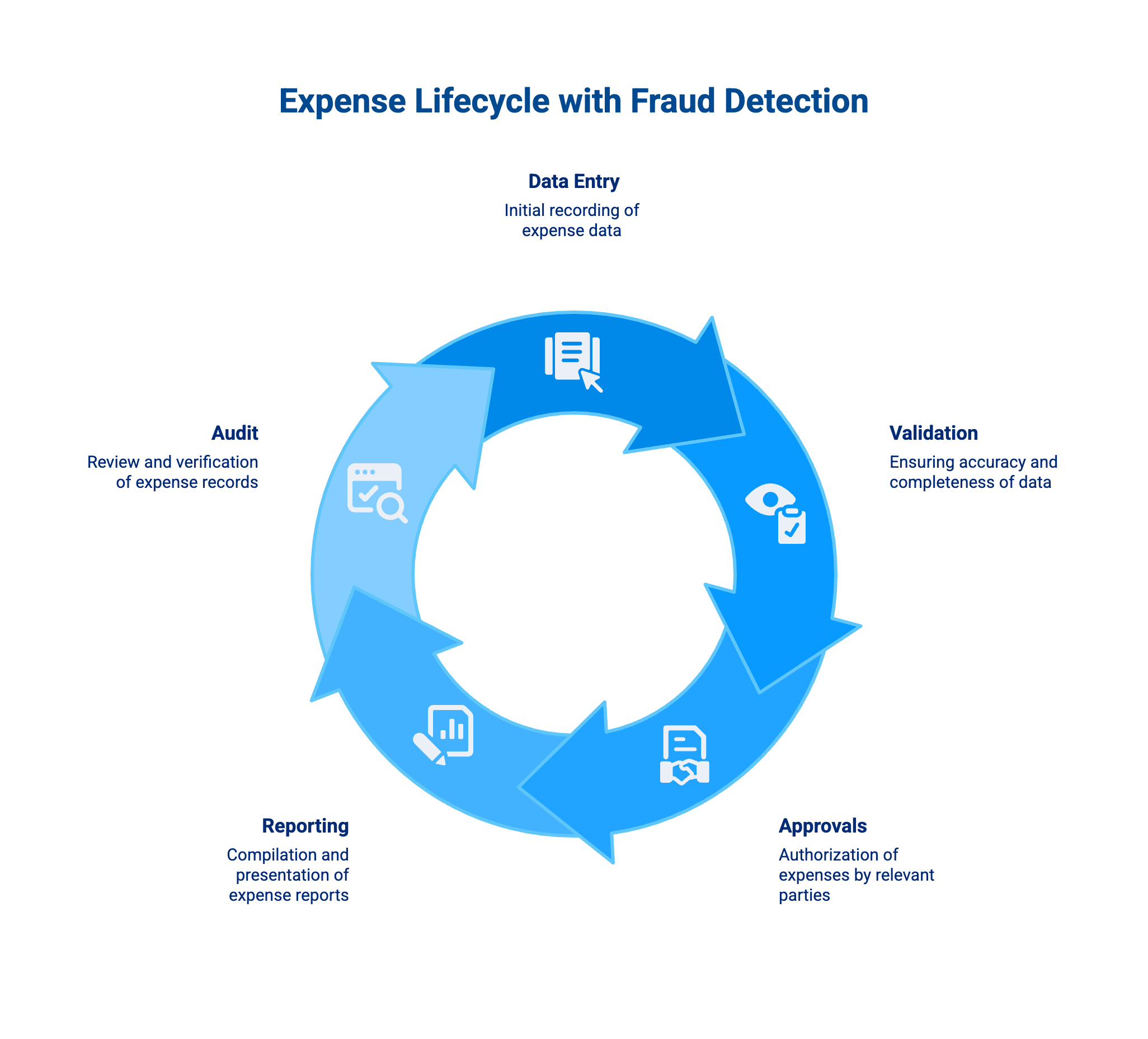

Fraud Detection in the Expense Lifecycle

Policy Controls: Per diem rules, allowed expenses, spending limits, approval hierarchies

System Controls: Duplicate receipts, mismatched dates, manipulated images, automated flagging

Understanding Expenses: Beyond the Imagery

Examining a receipt alone is insufficient; it requires context surrounding the expense, such as patterns and the time of day. Even AI can sometimes miss these nuances. Interestingly, AI that generates a fake receipt may not even realize it’s not real. Therefore, we should consider multiple aspects beyond just fake receipts to gain a clearer understanding.

To the right are common categories of expense fraud.

02 Transforming Audit & Validation with DATABASICS

Advanced OCR technology with intelligent matching and validation

OCR Extraction & Normalization

DATABASICS employs advanced OCR technology that provides robust receipt processing capabilities:

- Reads receipts in any orientation or condition

- Normalizes data formats for consistent processing

- Extracts key data: merchant, amount, date, taxes, currency

- Handles multiple languages and international formats

Receipt Match Logic

DATABASICS leverages advanced OCR technology to automatically extract key receipt details including date, vendor, amount, and currency, then matches them with corresponding expense entries.

User Experience Improvements

User experience improvements are evident through several key features:

- Error prevention: Auto-filled fields reduce user errors and improve accuracy

- Minimized data entry: OCR technology automatically populates expense fields

- Real-time feedback: Immediately flags issues, reducing approval delays

The Audit Module

DATABASICS's Audit Module provides comprehensive oversight capabilities with intelligent AI assistance:

- Condition-based audits triggered by specific criteria

- Duplicate detection across all expense reports

- Missing receipt reports and compliance tracking

- Custom rules for flagging expenses based on policies

- Advanced pattern recognition identifies anomalies

- Reports with amounts exceeding thresholds

- Users with unusually high rejection rates

- Duplicate attendees or meals across reports

DBee AI Assistant

DBee AI Assistant offers you the ability to pose your questions in simple English, allowing you to gain valuable insights from your expense data.

- Natural Language Queries: Ask questions in plain English to get insights from expense data

- Data Insights: Analyze patterns to identify trends and optimization opportunities

- 24/7 Availability: Round-the-clock support for time tracking and expense queries

💡Try Asking DBee:

- "Show me all expenses over $500 submitted this month"

- "Which employees have the highest expense rejection rates?"

- "Find duplicate meal expenses in the last quarter"

- "What are the most common policy violations?"

Receipt Match Features

.png?width=1548&height=2268&name=Fraud%20Detection%20in%20the%20Expense%20Lifecycle%20-%20visual%20selection%20(11).png)

.png?width=2016&height=1620&name=Fraud%20Detection%20in%20the%20Expense%20Lifecycle%20-%20visual%20selection%20(12).png)

The Receipt Mapping Process

.png?width=3132&height=1944&name=Fraud%20Detection%20in%20the%20Expense%20Lifecycle%20-%20visual%20selection%20(10).png)

How These Improve The User Experience

DATABASICS enhances the user experience with features purpose-built for efficiency and precision. Intelligent auto-filled fields proactively minimize errors, ensuring data integrity while streamlining entry. Advanced OCR technology captures and populates expense data automatically, reducing manual input and saving valuable time for users. Immediate, real-time feedback identifies and flags discrepancies as they arise, accelerating approvals and eliminating unnecessary rework. Together, these capabilities drive faster, more accurate workflows and empower finance teams to focus on higher-value tasks.

03 Third-Party Fraud Detection Providers

DATABASICS API Capabilities

If you already have an in-house or outsourced detection source, you can utilize our APIs to obtain the necessary data. You can easily extract receipts and information, which can then be flagged.

- Receipt images, OCR data, and metadata fully accessible

- Audit flags and validation results available in real-time

- Support for internal analytics teams and custom reporting

- Webhook notifications for immediate response to flagged items

.png?width=2232&height=1692&name=Fraud%20Detection%20in%20the%20Expense%20Lifecycle%20-%20visual%20selection%20(3).png)

Partner Integrations

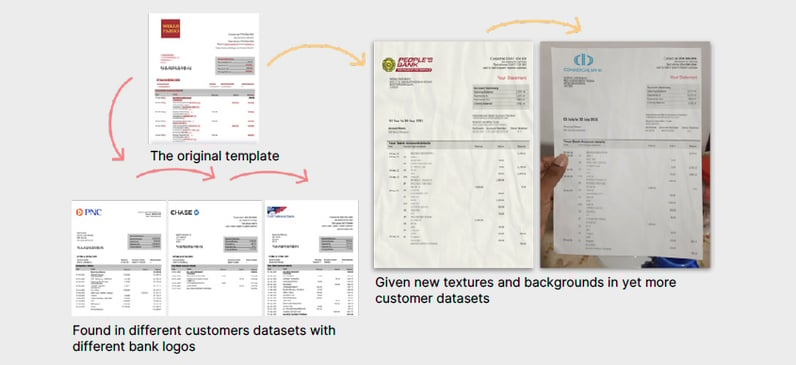

For organizations that need advanced forensic capabilities, DATABASICS collaborates with the leading fraud detection expert, Resistant AI. Our integration provides you with clear, actionable verdicts rather than ambiguous "risk scores."

What can you do with a 68% risk versus an 82% risk score? Eliminate the confusion and gain a straightforward understanding of your risk levels:

High Risk: This document is likely fraudulent and should be declined.

Warning: This document has been modified and requires review.

Normal: There are no issues with this document, and it can be accepted.

Trusted: This document matches authentically verified ones perfectly.

"As many as 2% of all onboarding and underwriting documents are based on reused or generated documents. Detect the most sophisticated threats to root out waves of crowdsourced first-party fraud and targeted attempts by tech-enabled organized crime rings." -- Resistant.AI

04 Our Recommendations

Cost-Benefit Analysis

When evaluating fraud detection investments, maintain perspective on actual risks:

- Transaction Size Matters: Analyzing small transactions may not justify sophisticated detection costs

- Reality Check: Creating convincing AI receipts requires significant effort

- Industry Context: Major competitors are also using third-party vendors

- Risk Profile: Investment should align with actual exposure

Best Practice: The most effective fraud prevention often occurs before expenses are incurred through controlled spending mechanisms and clear policies.

Prepaid Controlled-Spend Cards

To reduce risk, eliminate cash misuse, and improve expense visibility, implement prepaid, limited-value cards like the DATABASICS Visa® Commercial Card or the DATABASICS Visa® Prepaid Card:

- Controlled Spending Limits: Funds capped at predefined amounts, preventing overspending

- Category Restrictions: Cards limited to approved merchant types (fuel, meals, travel)

- Real-Time Monitoring: Every transaction logged immediately for better oversight

- Cash Elimination: Removes risks of cash advances and untraceable spending

- Better Compliance: Ensures purchases align with policy and audit requirements

- Simplified Reconciliation: Automated matching reduces manual work and errors

© 2025 DATABASICS, Inc., all rights reserved. The DATABASICS Visa® Prepaid Card, DATABASICS Disburse Visa® Prepaid Card, and DATABASICS Visa® Commercial Card are hosted by PEX, Prepaid Expense Solutions and issued by The Bancorp Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa business prepaid and Visa commercial cards are accepted. Please see the back of your card for its issuing bank.

Our Balanced Approach

Third-Party Integration

Audit Module

OCR + Receipt Matching

Prepaid Cards

DATABASICS begins by reviewing all your existing policies, data flows, and the pain points identified by your administrators, approvers, and end users. We then evaluate the entire system and implement targeted improvements, whether that means adding or refining policies, updating labels, enhancing product configuration, or training AI to support users, approvers, and administrators.

At the same time, we analyze any unusual charges and review policy effectiveness to ensure your audit and validation processes remain accurate, consistent, and efficient.

About DATABASICS

DATABASICS delivers timesheets, leave tracking, expense reporting, and employee purchasing management solutions that lead the industry in value, performance, and adaptability. Our comprehensive platform integrates seamlessly with major accounting, payroll, and HR providers. From regional businesses and nonprofits to global enterprises, DATABASICS customers rely on our intelligent automation, advanced analytics, and exceptional support to streamline workforce management while maintaining the highest standards of accuracy and compliance.

Ready to Learn More?

Discover how DATABASICS can transform your expense management with intelligent fraud detection and streamlined processes.

Email: sales@data-basics.com | Questions? Call us at 800.599.0434

Or, request a demo here:

Subscribe to Our Blog

Subscribe to our blog and get the latest in time tracking and expense reporting news and updates.